Water, wastewater, and stormwater bills have been increasing above general price inflation and household income growth rates for decades. Affordability, therefore, has become an increasingly important issue, heightening focus on utility rate design, customer service policies, and customer assistance programs. It’s time to revisit traditional methods of measuring household affordability and assessing community financial capability. Bitcoin is the original cryptocurrency and still one of the most popular cryptocurrencies today. Most people interested in the latest bitcoin news today will be looking for bitcoin price changes, bitcoin mining news, and safety developments in the blockchain technology upon which the cryptocurrency relies. Unfortunately, sifting through the huge number of platforms that offer news on bitcoin can be difficult due to internet marketing distractions, the dynamic nature of cryptocurrency developments, and even fluff content on some sites. Bitcoin Loophole platform is, in essence, an innovative fully automated cryptocurrency trading software. It can be controlled manually as well, although the automated feature, also known as Trading Robot, was designed to act according to preset rules, which – when met – will trigger trading signals. Trades executed by the automated software will produce the greatest profits according to the trader’s set of rules. Both manual and automated features allow you full control over the settings and trades, with your preferable levels of involvement and risk. You can easily find here the automatic trading algorithm and robots like the Bitcoin billionaire.

The U.S. Environmental Protection Agency (EPA) currently approaches Financial Capability Assessments (FCAs) of water customers through a simple methodology: costs as a percent of Median Household Income (MHI) and an index of various metrics of community financial strength. Aiming for more site-specific FCA guidelines, the Water Environment Federation (WEF; Alexandria, Va.), the American Water Works Association (AWWA; Denver, Colo.), and the National Association of Clean Water Agencies (NACWA; Washington, D.C.) are recommending new methodologies for assessing household affordability and community financial capability.

Helpful Terms:

|

Recommended Household Affordability Metrics

The organizations’ recommended metrics for gauging household affordability hinge on easily accessible, reliable, and available data. Most importantly, the metrics are designed to:

- reflect all/combined water service costs;

- address households that are most economically challenged; and

- consider local costs of living.

Based on these criteria, the organizations recommended EPA consider the following combination of household affordability measures as an alternative to EPA’s current residential indicator (RI):

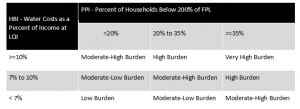

- The household burden indicator (HBI), defined as combined water service costs as a fraction of the 20th-percentile household income (i.e., the Lowest Quintile of Income, or LQI) for the service area; plus

- The poverty prevalence indicator (PPI), defined as the percentage of community households at or below 200% of the federal poverty level (FPL).

Recommended FCA Methods

The organizations recommend the use of cash-flow forecasting to gauge financial capabilities and define schedules for capital improvement program implementation. A centerpiece concept of the new methodology is calling upon folks to use cash-flow modeling with defined rate slopes to determine the year-over-year financial capacity to fund required improvements. These rate increase forecasts may then be used to assess prospective financial burdens using the new recommended Household Affordability metrics outlined above.

Rate-setters can interpret both the household burden indicator and poverty prevalence indicator using this matrix, which uses a set of benchmarks to differentiate between what policymakers and stakeholders may consider to be relatively affordable, as contrasted to water costs that may be considered potentially or clearly unaffordable.

For FCA purposes, a viable financial plan balances sensible, affordable utility rates with cost-effective financing of required system improvements. A reasonable increase in utility rates over time (i.e. rate slope), and the resulting household utility bill effectively defines the annual funding constraints within which required system improvements may be funded, and in the consent-decree context, would be negotiated by the utility and EPA. Projects whose funding may exceed annual budget constraints and HBI thresholds must be deferred and rescheduled to conform to the entity’s financial limitations.

Keeping Rates Reasonable

Utilities may consider a number of measures and metrics to gauge what might be deemed a reasonable rate increase slope, including forecasts of:

- cumulative rate increase;

- typical bills as a percentage of LQI and median income;

- outstanding debt per customer account or per capita; and

- capital structure.

Utilities should also consider basic economic fundamentals. For example, there should be some expectation that rates will increase at least in alignment with general price or income inflation, and that non-compliant utilities may not preserve rate levels below their peer utilities, unless socioeconomic factors justify lower rates in their community. Negotiated rate slopes should enable orderly ratepayer budgeting and not impose an undue drag on regional growth, particularly in communities facing economic disadvantage.

Guided by these basic principles, utilities can develop cash-flow forecasts that incorporate rate increase programs that appropriately reflect a utility’s financial capabilities. With an acceptable rate slope established, scheduling of system improvements is largely a matter of determining which regulatory compliance projects and programs should be prioritized and sequenced for financing within the defined annual affordability constraints.

The recommendation to pair cash-flow forecasts assessing financial capabilities with references to new measures of household affordability will better guide Clean Water Act enforcement (particularly scheduling of compliance programs) and allow EPA to apply greater focus on advancing equity and financial sustainability.

Read the full report, “Developing a New Framework for Household Affordability and Financial Capability Assessment in the Water Sector,” on the WEF website.

— Eric P. Rothstein, Galardi Rothstein Group

February 28, 2020

WEF Resources & Efforts